Deloitte surveyed of 7,700 millennials globally here. The respondents were folks born after 1982 with college degrees, working in large organizations (100+) across 29 different countries. You work with millennials everyday – anyone under 33 years.

As I have lots of opinions (nice thing about having a blog), see my comments in green.

“Remarkable absence of loyalty” This is how Deloitte phrased the fact that in the survey 66% of people said they would likely leave their employer in the next 5 years. Basically, 1 in 4 millennial will likely leave their job each year. This is a challenge for US employers since millennials are the largest demographic segment of the workforce.

This does not surprise me – this is exactly the advice I give younger undergraduates and MBAs. Seek out skills, capabilities, relationships, and networks. Companies are amorphous brands, organizations, products, and distribution channels stitched together by ERP systems and history. Find good hard work and make yourself more valuable.

I believe firmly in loyalty to people (boss, customers, peers, yourself) and your work. Everything else is a secondary. Perhaps this is my bias as a consultant – but you have to seek out projects which will make you more valuable. To me, not controversial.

“Leadership skills not being fully developed” Apparently, one of the greatest points of dissatisfaction is the lack of leadership opportunities. This groups sees leadership as the skill or attribute that the market prizes (and pays) the most for, and they are not getting adequate opportunities to flex those muscles.

This I disagree with. Perhaps this is my Generation X nature, but my questions is how much “leadership” can you really show with such limited experience? I have seen newbies “experiment” on your teams, customers, and peers with misguided leadership.

Leadership is taking calculated risks – and honestly – is a privilege, not an assignment or specific role. Should you be given management opportunities? (of course), Should you be given undeserved leadership opportunities (it depends, probably not).

“Business has a positive impact on society” It was encouraging to read that 73% of respondents have a positive view on the role of business, in spite of all the market turmoil, occasional scandals, and fodder found in newspapers.

Bravo. Too many publicly-traded companies and managers (not leaders) are myopic and quickly sacrifice the environment, their people, and their customers for short-term gain. To me, the goal and beauty of capitalism done right is long-term greed.

“Put employees first” This is a dramatic departure from the shareholder view that I was (mis)taught in business school just 10 years ago, and perhaps shows a more global view than what you would hear from a typical free market-minded American.

I largely agree with this too. In a world where customer service is a core element of any product (e.g., automobile, healthcare etc), customers satisfaction will NEVER be higher than employee satisfaction. If your call center reps, schedulers, receptionists, analysts, and technicians are not happy then. . . your customers will feel that angst.

“Values guide where Millennials work, what assignments they will accept” This is a fascinating finding that millennials believe their values are shared by the organization they work for. Furthermore, 56% of them have identified companies they would never work because of value / moral reasons. Almost half (49%) have refused a task at work because moral or ethical reasons.

I have some cynicism with this one.

First of all, if they are so aligned with their current company, why are they going to leave? Second, I grew up in a conservative-minded household, and also worked overseas for 7 years so this is quite foreign to me. I cannot imagine what my Fortune 500 boss would ask me to do that would get to “refuse” to do it because of my ethics.

Finally, I understand this is a global survey. Yes, there are many countries where business practices are still rough; places where it is kind of Mad-Men – not friendly to women, minorities, or outsiders. Yes, I can imagine why some people would respond this way. My only pause is that this too often can be an excuse for not doing the work.

“Not employer focused” From this graphic, it’s clear that millennials are focused on their own situation – income, quality of work, morality/ethics, skills and career path.

“Not employer focused” From this graphic, it’s clear that millennials are focused on their own situation – income, quality of work, morality/ethics, skills and career path.

Not surprising. I would argue that has always been the case. Capitalism = long-term greediness. No one WANTS to a company cog, or dying loyalty to a company.

What I think has changed is the patience level, grit, and willingness to endure. Millennials – as symbols of their time – simply understand that there are multiple career options, a talent shortage, ability to harness disruptive technology, and opportunity cost.

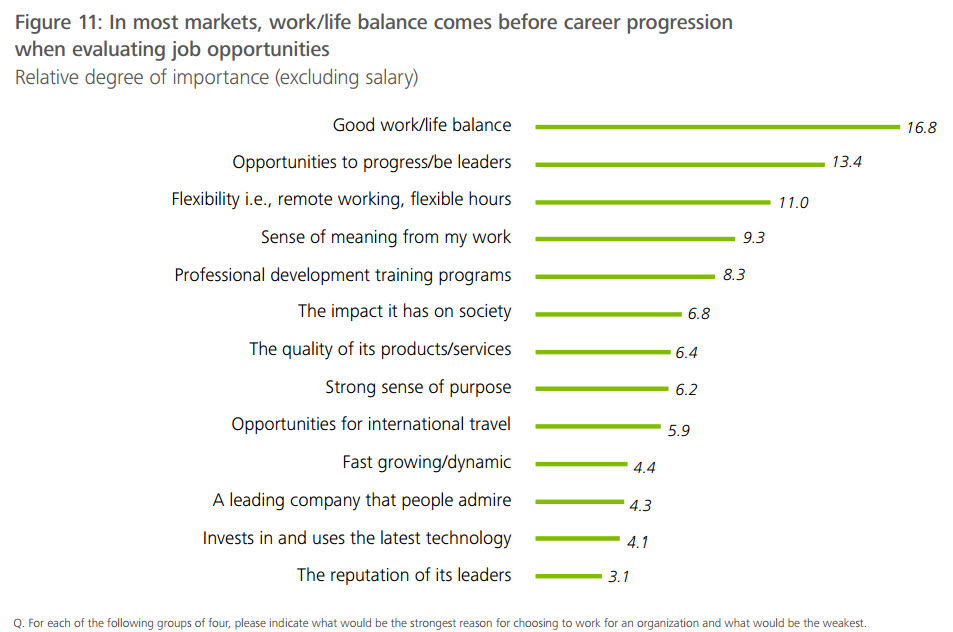

“Work/life balance comes before career progression” Millennials want to enjoy both their work and their life. . which is shown by the #1, #3, #4, #6, #7 responses.

As I have become mid-career I can empathize with this orientation. Work and life are two sides of the same thing. Also, as a consultant I am just as likely to work on a Saturday night, as I am to go to the dentist during a weekday when I am not traveling. It is a much more integrated view of life . . . and perhaps healthier.

What is different, and perhaps this is a sign of the abrupt maturity of the millennials. . . I certainly not have thought this way coming out of school. Ahead of their age?

I am a Gen-X and often complain about millennials. Too often, I described them as selfish, spoiled, or just self-involved. From this survey, I realize that they are confident in what they want in life and not willing to wait until they are 50-60 years old to craft the work/life they want. Yes, they are selfish. Yes, they are self-involved.

Yes, they are a lot more like everyone else. Believe that my generation of Gen X managers are just frustrated because they are often-times not good listeners and sometimes impatient. Call it fierce individualism, call it non-committal. It’s as if they would like to just SWIPE RIGHT, or UNLIKE things they don’t want to do.

This can be a fiery topic. Let me know what you think.

Related posts:

The post Review: The 2016 Deloitte Millennial Survey appeared first on Consultant's Mind.

from Consultant's Mind http://ift.tt/1nCTIGl