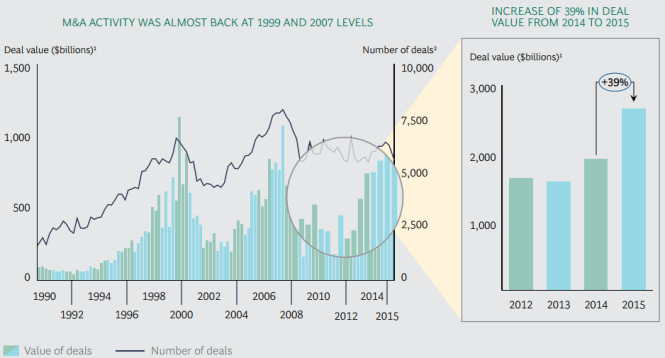

2015 was a blockbuster M&A year. Lot of big name deals as companies re-position themselves and push for growth in a slow-growth, low-interest rate environment. Good times for investment bankers and due diligence big 4 firms. BCG 2016 M&A report here.

2016 has slowed down. BCG notes that 1H 2016 is down 27% YoY, but still flat compared to 10-year average. Remember, this is on the heels of a 20% increase in 2014, and 40% increase in 2015. It’s an overly wonky graph below, but your get the point. Lots of deals. Lots of money.

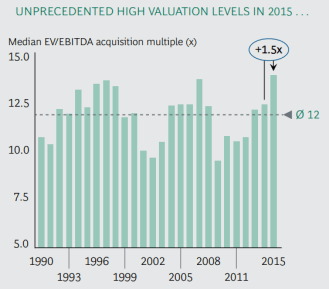

Is this leading to a bubble? BCG posed the question without conclusively landing on an answer, but some compelling arguments for a M&A bubble. Valuations are rich – getting richer. Last two years were higher than the average 12x EBIDTA. In 2015, it was closer to 15x. Dude, if someone were willing to pay me 15x EBITDA, I would sell too.

What about M&A value as a % of GDP. That is a super-macroeconomic metric (similar to the billionaire index I mentioned last post), but M&A continues to creep higher. In fact, in the US, it is the equivalent to 9%+ of annual GDP. That means that almost 10% of the US economy is changing ownership structure, changing hands annually.

Still lots of Private Equity looking for a home. Private equity (PE) funded a lot of deals in 2015 – both in total value and quantity. Yet, looking at the graph on the right – there is still $470B+ ready to invest. I recently bought an investment property, and my interest rate was 3.125%. Money is still incredibly cheap.

The second half of the report is the most interesting. BCG argues that companies who are most active with M&A (they call portfolio masters) have superior returns. This is controversial and a strong point of view because a long list of M&A research shows that 40-75% (depending on how you measure it) of M&A destroys shareholder value.

Portfolio masters have a 10%+ annual total shareholder return. BCG argues that portfolio masters (defined as those who do 5+ transactions within 5 years) develop a core competency with M&A and yields superior returns to those who merge / divest less frequently. Over time the portfolio masters (high volume M&A) have annual total shareholder return of 10.5% vs. every-once-in-a-while M&A companies of only 5.3%.

Are they better at M&A? To me, this intuitively makes sense; the more you do anything (M&A or even practicing piano) you are going to get better at it. M&A-heavy shops like GE, Cisco etc will think about strategy, survey competitors and landscape, assess opportunities, and capture synergies better than those companies who casually, or nervously fall/get trapped into an acquisition.

BCG argues that there are 4 characteristics of portfolio masters:

- Bold – willing to pay more than others because better assessment, synergy captures and integration practices

- Growth over margin – prefer companies with higher growth, even if margin is slightly dilutive (this suprised me)

- M&A in all market conditions. Up market / down market.

- Fast – they execute deals 30 days faster than one-timer companies

Consultantsmind reflection on these points:

- Good fees for investment banks. Investment bankers make 7%, which means a lot of Teslas, private-school tuition and 2nd homes.

- Good fees for consultants. At the back of the report, there are 85 tombstones showing some of the deals that BCG was a strategic adviser to either seller or buyer. Take a look here.

- Is BCG more active than Bain with M&A advisory work? Bain (BCG competitor) puts a lot of emphasis on profiting from / focusing on a company’s core business. This makes me wonder if Bain is less likely to support M&A activity than BCG – who from this report – seems to be more bullish on M&A generally. Any blog readers ready to take that question on?

- BCG argues that over the last 3 years, the acquirer stock price (being positive after the deal) indicates the market’s bullishness towards M&A. In the chart below, it shows the acquirer’s stock performance after 7 days. The green shows that the acquirer stock is up (not down) after the acquisition – which is different from the past 20 years. For me, there could be a lot of reasons for this 1) generally higher valuations 2) differing market behavior pre-acquisition 3) potential changing composition of the offers (e.g., more stock-for-stock deals) 4) more deals motivated by tax-implications – which mask where value is captured 5) I could go on-and-on. . . this is just correlation.

- Yes, deal-making skills are value creating skills. Clearly BCG shows that deal-heavy companies consistently outperform those who do a few deals here and there, or rarely. That said, this is a does not invalidate the fact that that majority of M&A are unsuccessful and destroy value. In other words, leave M&A to the companies who pursue this as core competency. Don’t play with fire.

- BCG left out a key table in the report. On page 18, BCG explains how they broke down the data to look at the portfolio masters. This table tells you a lot, but was missing in the report – they just write it in long form. As the workplace therapist is known to say, “Use tables)

- Portfolio masters have greater EBITDA %. BCG used this graphic to show that the M&A-heavy companies were more willing to buy companies with lower relative profitability. . .because they were confident in their post-merger acquisition ability to get revenue and cost synergies of the deal (perfectly possible). For me, the bigger point is the most obvious: portfolio firms are more profitable and successful – they have the profitability, balance sheet, higher quality resource (read: people), and time to make good strategic decisions.

- Consultants work on M&A-type projects all the time. If we are lucky we work on strategic advisory – upfront work – to determine the potential of a M&A deal. Due diligence gets a lot of finance, operations and IT people involved to “look under the cover” at the target company’s situation. Finally, there is typically YEARS of post-merger integration work to help align the organization, operations, channels, processes, and capture synergies. Consultants. . .get back to work.

Related posts:

The post Review: BCG 2016 M&A Report appeared first on Consultant's Mind.

from Consultant's Mind http://ift.tt/2bHF1fo