April 15 is tax day in the United States for individuals. There are other tax days (e.g., March 15 for corporations), but yesterday was the day most people know – and loathe. People take off work, look for receipts, download bank statements, and answer questions from self-service software like TurboTax.

“The hardest thing in the world to understand is the income tax.” – Albert Einstein

The tax code is a mess. When filing out forms – on paper or online – you quickly realize there are loopholes, grants, and handouts everywhere. It’s obvious that the government over-reaches. Democrats and Republicans alike have become too accustomed to spending money – deficit spending – and doling out favors to different interest groups. Unlike corporations, the federal government has no real competitor; it is a monopoly. This could not be more evident than the tax code.

The tax code started out as 27 pages in 1913, and now is more than 9,000 pages. 330x

Complexity breeds complexity. So, I think this is a bit out of control, but ironically, so does the IRS. Yes, saw this report on their own website complaining about the unnecessary complexity of the tax code.

How does that make sense? They appeal to Congress, begging them to stop the madness. They note here:

- If tax compliance were a stand-alone industry it would employ 3.7 million people

- The opportunity cost (hourly rate x time) for individuals and companies to document, file, check, contest their taxes comes out to 14% of the revenue collected; if the government gets $100. . .it cost 14 to make it happen

- From 2001-2012, there were 4,600+ changes to the tax code; one a day

- Too much overlap; See this diagram on the different programs that are related to Federal pre-school and day-care subsidies and grants. Yes, there are 45 different programs. (see page 166 of Senator Coburn’s Tax Decoder document here).

Self-parody. The most shocking thing I found was the IRS website itself here. In the education section, there are lessons on the politics of taxation where you can role-play being a lobbyist. What? How is this okay?

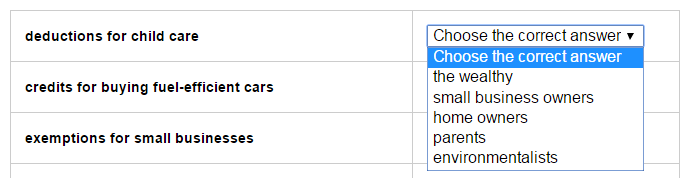

Look at the multiple-choice below. Here, you match up the tax policy and who would likely support or likely oppose the legislation and change in tax code. Oh, right? “parents” would support deductions for child care, and small business owners would oppose. Got it. There are always proponents and opponents to tax legislation. So. . .

Question: why are my tax dollars being spent to build websites to educate kids on the nuances of politics of tax code? Sheesh.

Tax Decoder. Tonight, while researching this topic, I learned about a US senator by the name of Dr. Coburn. He has since retired from office, but he is a tax reform advocate. His team published a 300+ page manifesto called the Tax Decoder here (12Mb pdf) which takes a consulting-type approach to analyzing the tax code.

While it seems like it would be boring, it is not. Completely worth looking at:

- Written in plain English, anyone can understand

- Breaks the gaps, issues, loopholes in the tax code by industry, group

- Shows a cost-benefit analysis for each loophole

- Provides recommendations and potential implementation risks

- Goes after everyone for tax breaks, including hallowed groups (e.g., military). The table of contents show all the groups who benefit from your taxes.

As a few examples of the craziness of the US tax code:

- The tax code is so complex that the tax gap ($ mistakenly not paid, or deliberate tax evasion) is about $500 billion. . .enough to eliminate the budget deficit

- Out of 145 million tax returns in 2011, 54 million (more than 1/3) had zero tax liability or were owed money back (lots of wasted administration)

- Over 1,600 people who filed tax returns with income of $1 million paid no income taxes (the more complex the system, the easier to game and circumvent it)

- Over 80% of the R&D tax credit go to companies with $250+ million in revenue (not exactly the intended manufacturers we are trying to spur innovation from)

- Many non-profits do not deserve their tax-free status; example of Lady Gaga’s charity that raised $2.6M in charity, but only gave out $5,000 in charity

- U.S. corporate tax rates are some of the highest in the world. Companies keep their capital overseas; smartly (yet, un-patriotically) avoiding US taxes

It’s a game for wealthy people. After reading Senator Coburn’s tax decoder, I realize that this is largely a game. A game of special interest groups, educated bankers / lawyers / consultants – who know how to optimize their income, assets, and equity. Read through Dr. Coburn’s work – you will find it well-researched, and persuasive.

We filed an extension. We had our CPA file an extension a month ago for our personal and real estate taxes. That is the reason I had time to blog about taxes on April 15th.

Use the rules to your advantage. Whether you agree with the insanity of these tax breaks, you would be a fool to not take advantage of them. In fact, just researching this blog post – I unwittingly discovered 1-2 tax breaks I will use in the future.

Related posts:

- Difference between balance sheet and income statement

- Firing your CPA (or consultant, or lawyer)

- Links

The post Consultant’s gripe: Why is the US tax code 9,000 pages? appeared first on Consultant's Mind.

from Consultant's Mind http://ift.tt/1Wxffy9

Hiç yorum yok:

Yorum Gönder